The Impact of Duration on Sensitivity to Rate Changes

The graph above demonstrates the impact that duration has on the sensitivity of bond prices to interest rate changes. This post explains how duration is calculated and

used.

Bond Maturity & Interest Rate Risk

In Yield to Maturity & Interest Rate Risk, we saw that rising interest rates result in falling bond prices, and falling interest rates result in rising bond prices. How much prices rise or fall depends not only on how much interest rates rise or fall, but also on the timing of future payments.As a general rule, the sooner a bond is maturing the less sensitive it is to increases and decreases in interest rates; bonds maturing in one year are less sensitive to changes than bonds maturing in 20 years. Intuitively, the longer your money is outstanding, the more it is at risk.

Duration & Interest Rate Risk

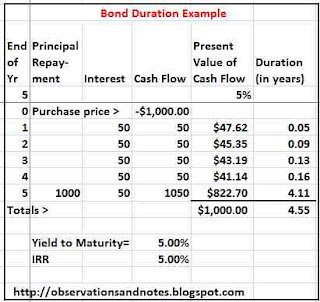

Bond Duration Example

Duration measures your interest rate risk more precisely than maturity. In fact, duration is dollar-weighted maturity. In the table above, the "present value of cash flow" column shows the present value of the cash inflows from this bond, by year. The "duration" column shows the years of duration attributable to each year in the life of the bond. The number shown for each year is the year times the percentage of the cash flow received in ("maturing" in) that year. For example, ($822.70 / $1000 =) 82.27% of the total cash inflow occurs in year 5. Applying that weight to year 5, we get (82.27% x 5 years =) 4.11 years contributed to the duration total.

Note: If this were a zero-coupon bond, 100% of the inflows would occur at maturity, and the maturity and duration would both be 5 years. In all other cases, duration is less than maturity, reflecting the fact that some portion of the income is not at risk for the full maturity period. Click here to see the Excel spreadsheet and the underlying calculations.

In the graph at the top of this post, we have plotted the response of this $1,000 5-year bond to interest rate changes in blue (the solid line). The horizontal axis shows interest rates relative to the initial rate of 5% -- i.e., it shows the increase or decrease in interest rate. Similarly, the vertical axis shows the change in price from the original price of $1,000.

In contrast, we have also plotted the results for an equivalent 20-year bond. That bond has a duration of 13.09 years, and is represented by the dashed red line. As you can see, the bond with the longer duration is more sensitive to changes in interest rates. For example, if rates rose 2% the 4.55 year duration bond would decrease in price by less than $100. Under the same scenario, the 13.09-year duration bond would decrease by more than $200 -- more than twice as much. The longer duration bond is even more sensitive to interest rate decreases.

Using Duration to Estimate Sensitivity to Interest Rate Changes

Knowing the duration allows you to estimate the impact of interest rate changes on your bond. The market value of a bond with a duration of n years will increase (decrease) approximately n% for every 1% decrease (increase) in interest rates. Therefore, in this case we would estimate that a 2% increase in interest rates would result in a (2 x 4.55%=) 9.1% decrease in the value of the 5-year bond, to approximately $909. The actual value would be $918. We would estimate that a 2% decrease in interest rates would result in a 9.1% increase in the value of the bond, to approximately $1091; the actual value would be $1091.59.Managing Interest Rate Risk

As I said before, you cannot avoid the risk that interest rates will rise. However, you can influence the impact that any increase in rates will have on your portfolio. Keeping you maturities & durations relatively short reduces the impact of interest rate increases.Note: In this series I am ignoring taxes and transaction costs. In addition, the calculations assume the bonds pay interest annually.

Related Posts

Bond Basics -- e.g., I = PRT.Fundamentals of Investment Valuation: Intro to the concept of present value

Yield to Maturity & Interest Rate Risk why rising interest rates cause falling bond prices.

Treasury Bond Interest Rates since 1900 -- to provide perspective.

Wikipedia Bond Duration for a more detailed discussion of duration

Wikipedia Bond for a more extensive discussion of bonds in general

Why Did My Bond Fund Lag When Treasuries Rallied? A Morningstar article with an interesting "real world" example of the impact of duration.

For a list of other popular posts by subject area, see the sidebar to the left or the blog header.

Share This Article

To share via Facebook, Twitter, etc., see below.

Copyright © 2011 Last modified: 1/30/2013

No comments:

Post a Comment

No spam, please! Comment spam will not be published. See comment guidelines here.

Sorry, but I can no longer accept anonymous comments. They're 99% spam.